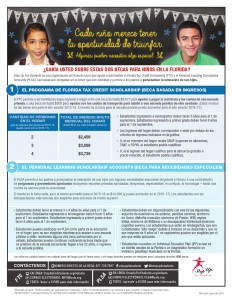

Step Up For Students is a non-profit organization that helps administer the Florida Tax Credit Scholarship (FTC) and the Personal Learning Scholarship

Accounts (PLSA) program.

The scholarships are awarded on a first-come, first-served basis and empower families to customize their children’s education.

FLORIDA TAX CREDIT SCHOLARSHIP PROGRAM (INCOME-BASED SCHOLARSHIP)

The FTC allows low-income families to choose between two K-12 scholarships. One is worth up to $5,677 to help cover private school tuition and

fees, and the other is worth up to $500 to assist with transportation costs to attend a public school in another county. (These scholarship amounts

are for the 2015-16 school year. The private school scholarship amount may increase for the 2016-17 school year.)

PERSONAL LEARNING SCHOLARSHIP ACCOUNTS (SPECIAL NEEDS SCHOLARSHIP)

The PLSA allows parents to customize the education of their children with certain special needs by directing money toward a combination of approved

programs and providers including approved private schools, therapists, specialists, curriculum, technology— even a college savings account.

The scholarship amount varies, but the average amount for 2015-16 is $10,000 (and may increase in 2016-17). Students with the most severe

disabilities are eligible for a higher scholarship amount.

For more information, visit the Step Up For Kids website.

You can also check these flyers (English/Spanish):